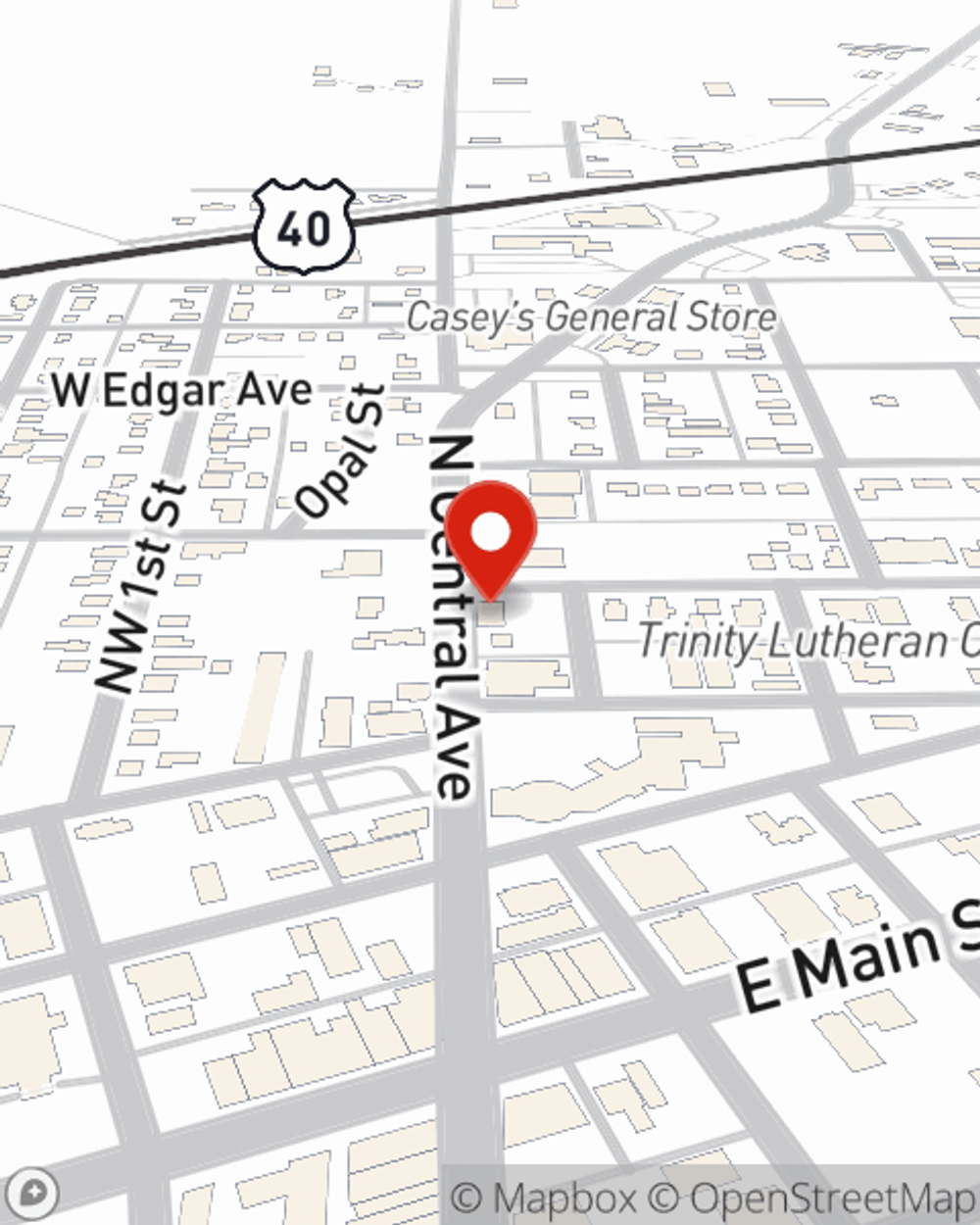

Life Insurance in and around Casey

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

No one likes to focus on death. But taking the time now to secure a life insurance policy with State Farm is a way to express love to your partner if you pass away.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Their Future Is Safe With State Farm

The beneficiary designated in your Life insurance policy can help meet important needs for your family when you pass away. The death benefit can help with things such as utility bills, college tuition or phone bills. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, dependable service.

Don’t let concerns about your future make you unsettled. Get in touch with State Farm Agent Mike Kirk today and discover how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Mike at (217) 932-2542 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.